About Club for Growth

Fighting for Economic Growth, Together. The Club for Growth is a national network of over 500,000 pro-growth, limited government Americans who share in the belief that prosperity and opportunity come from economic freedom. The leading free-enterprise advocacy group in the nation, we win tough battles and we have an enormous influence on economic policy. The Club for Growth is the only organization that is willing and able to take on any Member of Congress on policy who fails to uphold basic economic conservative principles…regardless of party. We pinpoint key bills up for debate in Congress. We exert maximum pressure on lawmakers to vote like free-market, limited government conservatives. And if they don’t, we hold them accountable by publicizing their voting record.

Club for Growth PAC

Endorsed Candidates

Ted Cruz

U.S. Senate, Texas

Bernie Moreno

U.S. Senate, Ohio

Jim Banks

U.S. Senate, Indiana

Scott Baugh

California's 47th Congressional District

Alex Mooney

U.S. Senate, West Virginia

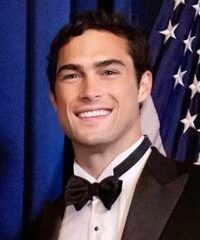

Brandon Gill

Texas' 26th Congressional District

Latest News

New CFG Action Ad Hits Capito in WV-GOV Race

Washington, D.C. – Club for Growth Action has released a new ad in West Virginia’s gubernatorial race, bashing Moore Capito’s...

RINO Speaker Phelan Worked To Save DEI & Kill School Freedom In Texas

Last week, Texas House Rep. Brian Harrison spoke out against Speaker Dade Phelan’s work to save DEI in Texas. Club...

NEW ECLIPSE VIDEO: Phelan & TX RINOs Opposition To School Freedom Eclipses Students & Leaves Parents In The Dark

Washington, D.C. – Club for Growth Action has released a new web video highlighting how Texas House Speaker Phelan and other...

Media

- Show all

- Media Hits

- Political Ads

- Brand

- Issue Ads

Bitcoin Freedom PAC

Helping elect candidates for Congress who will fight for Bitcoin freedom and against any government overreach of Bitcoin.

Learn More