About Club for Growth

Fighting for Economic Growth, Together. The Club for Growth is a national network of over 500,000 pro-growth, limited government Americans who share in the belief that prosperity and opportunity come from economic freedom. The leading free-enterprise advocacy group in the nation, we win tough battles and we have an enormous influence on economic policy. The Club for Growth is the only organization that is willing and able to take on any Member of Congress on policy who fails to uphold basic economic conservative principles…regardless of party. We pinpoint key bills up for debate in Congress. We exert maximum pressure on lawmakers to vote like free-market, limited government conservatives. And if they don’t, we hold them accountable by publicizing their voting record.

Club for Growth PAC

Endorsed Candidates

Ted Cruz

U.S. Senate, Texas

Bernie Moreno

U.S. Senate, Ohio

Jim Banks

U.S. Senate, Indiana

Scott Baugh

California's 47th Congressional District

Alex Mooney

U.S. Senate, West Virginia

Brandon Gill

Texas' 26th Congressional District

Latest News

New CFG Action Ad – Former Orange County TX GOP Chair Slams Phelan

Washington, D.C. – Club for Growth Action released a new ad targeting Speaker Dade Phelan in the Texas State House...

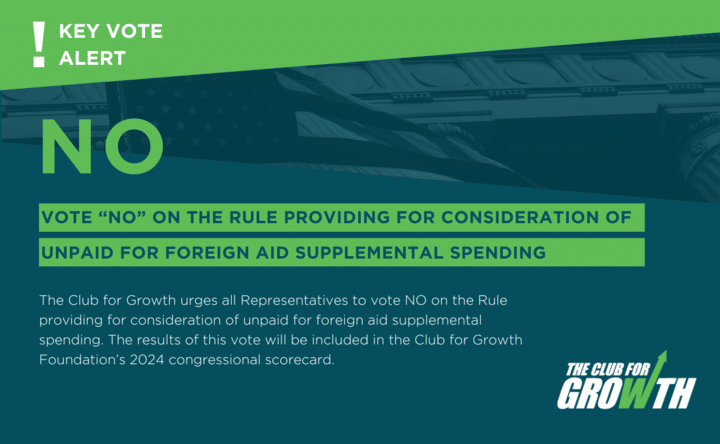

Key Vote Alert – “NO” on the Rule Providing for Consideration of Unpaid for Foreign Aid Supplemental Spending

The Club for Growth urges all Representatives to vote NO on the Rule providing for consideration of unpaid for foreign aid supplemental...

NEW: Club for Growth Action Launches New Ads Across 5 Districts in TX-HD Runoffs

Washington, D.C. – Club for Growth Action has released 5 unique ads, spanning across 5 individual districts, in the Texas...

Media

- Show all

- Media Hits

- Political Ads

- Brand

- Issue Ads

Bitcoin Freedom PAC

Helping elect candidates for Congress who will fight for Bitcoin freedom and against any government overreach of Bitcoin.

Learn More